Posted April 6th, 2020 in Top Stories, Legal Insights with Tags COVID-19, COVID-19 for Nonprofits

CARES Act Loan FAQs for Nonprofits, Foundations and Small Businesses

The U. S. Small Business Administration (SBA) on April 2, 2020, released an Interim Final Rule regarding how the agency will implement the “Paycheck Protection Program” of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The CARES Act also expands the SBA’s long-standing Economic Injury Disaster Loan Program (EIDL).

Here are some Frequently Asked Questions as to why nonprofits, foundations, and small businesses should be paying attention to these CARES Act loan programs.

What is the Paycheck Protection Program, and how does it impact small businesses (with 500 or fewer employers)?

The Payment Protection Program is available to small businesses and charitable nonprofits with 500 or fewer employees. Employees of affiliate nonprofits may be counted toward the 500 employee cap, depending on the degree of parent control.

The Paycheck Protection Program, although structured as a loan, is essentially a grant providing small entities with enough cash to cover payroll costs so long as the loan forgiveness requirements are met. Under the Program, up to the full principal loan amount may be forgiven (1) if the loan proceeds are used on payroll costs for eight weeks after the loan is disbursed and (2) the borrower maintains employee and compensation levels. The loan also allows entities to rehire furloughed employees. We expect the SBA to issue additional guidance on loan forgiveness soon.

How does the CARES Act expand the EIDL?

The EIDL program provides financial assistance to small businesses and nonprofits that suffer substantial economic injury as a result of the COVID-19 pandemic. An EIDL working capital loan can help nonprofits meet the necessary financial obligations that it could have met had the pandemic not occurred.

As we mention in response to Questions 3 and 4 below, there are limits to the loans that an entity can receive under the CARES Act. Keep reading for information about which loan might make the most sense for your organization.

Are there limits on using the Paycheck Protection Program loan proceeds?

To qualify for loan forgiveness, the Paycheck Protection Program loan proceeds must be used for:

- Payroll costs, including benefits (capped at $100,000 annualized for each employee);

- Interest on mortgage obligations, incurred before February 15, 2020;

- Rent, under lease agreements in force before February 15, 2020; and

- Utilities, for which service began before February 15, 2020.

However, not more than 25% of the loan proceeds may be used for non-payroll costs.

The total loan amount available under the Paycheck Protection Program loan is the lesser of $10 million or 2.5 times the average total monthly payroll costs from the one-year period prior to the date of application. If the payroll costs are seasonal, entities may elect to instead use average monthly payroll between February 15, 2019, and June 30, 2019, excluding costs over $100,000 on an annualized basis for each employee. The Interim Final Rule provides a payroll-based formula and examples.

Are there limits on using the EIDL loan proceeds?

Only specific organizations are eligible for an EIDL. Generally, the following entities that have suffered a substantial economic injury caused by the pandemic and provided they were in existence on January 31, 2020, are eligible:

- Small businesses with fewer than 500 employees

- Cooperatives, ESOPs, and tribal small businesses with fewer than 500 employees

- Sole proprietors

- Independent contractors

- Most nonprofits (existing EIDL limits apply – excluding nonprofits of a certain size and excludes religious institutions and some other charitable organizations)

The EIDL loan proceeds should be used to cover ordinary and necessary operating expenses, and reductions in working capital incurred in connection with the COVID-19 pandemic. This includes:

- Fixed debts,

- Payroll,

- Accounts payable, and

- Other bills that an entity cannot pay as a result of the pandemic’s impact.

Nonprofits seeking funds under the EIDL may request a “Grant Advance” of up to $10,000, payable three days after the application to the EIDL program. The advance is to be used to pay eligible and imminent operating costs related to the COVID-19 pandemic, such as increased cost of materials, payroll, rent, or mortgage payments. Nonprofits do not have to pay the Grant Advance back, even if the nonprofit is later denied an EIDL.

How does an entity apply for the Paycheck Protection Program?

The Program grants loans on a “first-come, first-served” basis, with no applications accepted after June 30, 2020. There is no collateral, personal guarantee, or application fees under the Paycheck Protection Program. Here is the final application form issued by the U.S. Treasury Department.

How does an entity apply for the EIDL?

Small businesses and nonprofits interested in applying for an EIDL should apply online through SBA’s secure Disaster Loan Assistance online application.

Can entities apply for more than one loan?

It depends. An eligible borrower may only receive one Paycheck Protection Program loan. An entity may be limited in obtaining an EIDL if it received another loan under the Paycheck Protection Program and if the loans are being used for the same thing. On the other hand, an entity could receive an EIDL and a loan under the Paycheck Protection Program if they are used for different purposes. Additionally, applicants can have an existing SBA Disaster Loan and still qualify for an EIDL disaster loan; however, the loans cannot be consolidated.

What factors should an entity consider when choosing between the two types of loans?

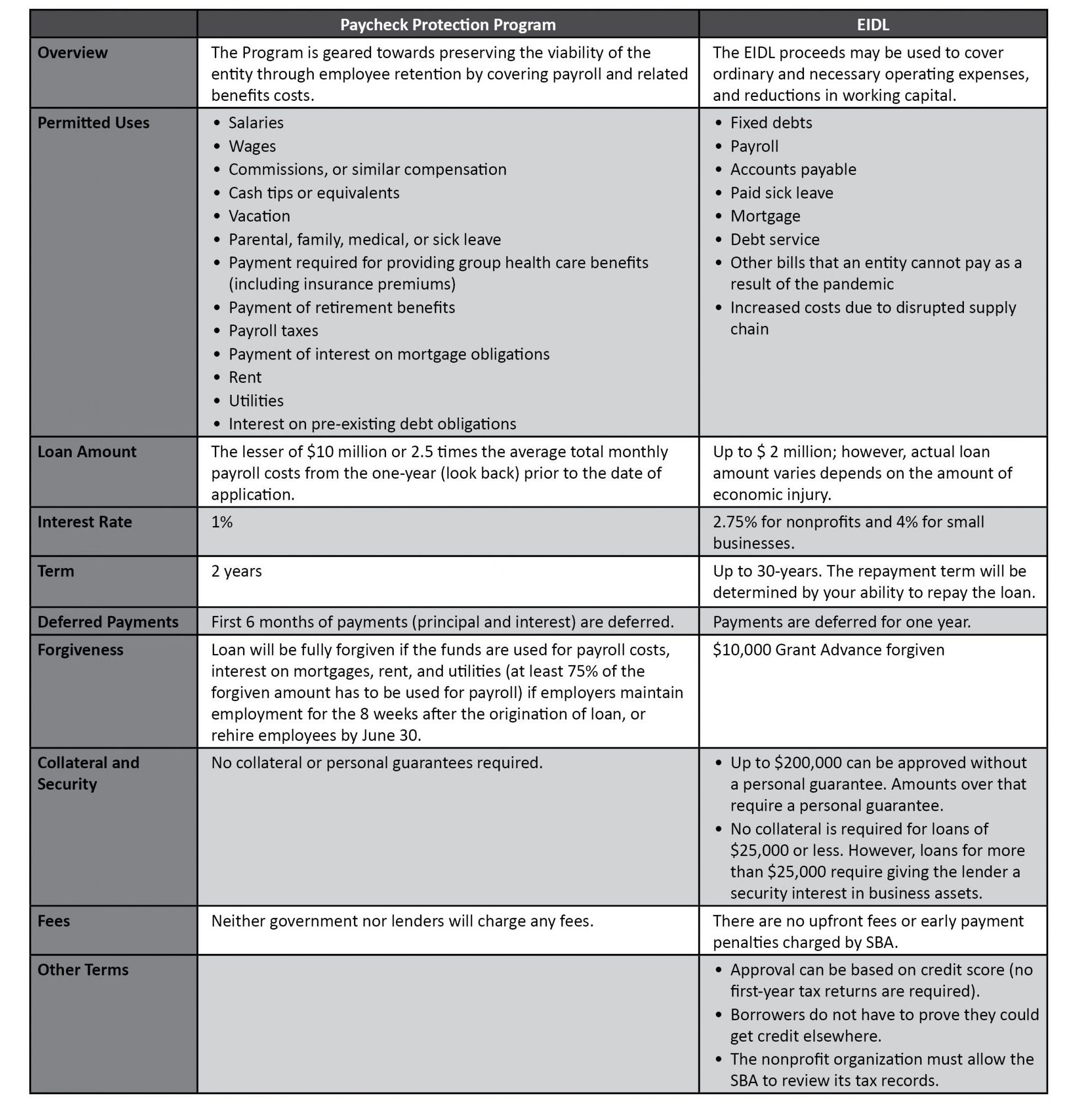

Below is a summary of the primary loan terms for both the Paycheck Protection Program and the EIDL. The entity should evaluate the various loan parameters to figure out what loan makes more sense for its business.